How to Calculate Compound Annual Growth Rate (CAGR) in Excel

※ Download: Cagr formula excel

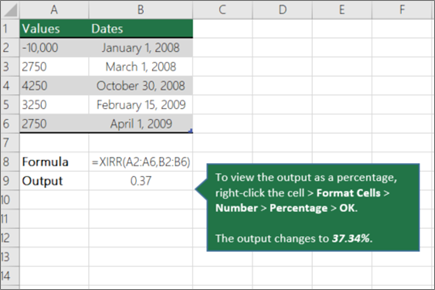

Also, note that the present value variables includes a negative sign, without which the formula will return an error. This investment was held for 5.

Here is the formula that will calculate the CAGR. Where do you use it? CAGR stands for compound annual growth rate. CAGR can be used to compare investments of different types with one another.

CAGR Calculator & Formula - The formula in H8 is: Excel Formula Training Formulas are the key to getting things done in Excel.

How to calculate CAGR Compound Annual Growth Rate in Excel CAGR or Compound Annual Growth Rate is one the most often used financial tool to evaluate an investment over a time period. You can use our to easily get the CAGR value with in-depth table report and chart graphics. In the case of no internet access you can use Microsoft Excel Linux alternative for Excel is LibreOffice Calc or OpenOffice Calc to calculate the CAGR. Let's see how to use the above formula in excel. Suppose we have following data for year and the investment value in the respective year. YEAR AMOUNT 2008 1000 2009 1242 2010 1456 2011 1677 2012 1899 2013 2356 2014 2466 2015 2134 2016 2516 Step 1 You can use the above data to fill inside the Excel. This makes the the value in the B2 cell i. Step 2 Now, we have all values that can be applied in the above mentioned formula. In this case, the CAGR value will be 0. That's it, this is how you can calculate CAGR or compound annual growth rate for an investment using Excel.

Where do you use it. As I mentioned, RATE function can be used for much more than just calculating the CAGR. CAGR is a great measure of growth, as it isolated the effect of compounding on growth, which is sometimes concealed on other metrics for growth. You can do that by right-clicking D3 and selecting Format Cells from the context menu. Years pass and one day out of boredom jack looks thru mail and stumbles on a credit card bill. The RATE function is made for much more than just CAGR. The difference between IRR and other formulas discussed above is that by using IRR, you can account for different value payments made during the time period. If your values are in A2:A5, e. Compound Annual Growth Rate CAGR for cagr formula excel is a financial term that measures the mean annual growth rate of an investment over a given period of time. But interesting application nevertheless. Resources saved on this page: MySQL 12.